Social Disability Lawyer Blog

What are the Non-Medical Requirements for SSDI 2021

To qualify for Social Security Disability Insurance, SSDI you would need to meet the eligibility for both medical and non-medical qualifications for SSDI. The most common reason for denial is not being able to meet the medical qualifications but an inability to meet the non-medical criteria. This happens simply because not many people are aware of it.

While you might be chronically ill and meet all the medical requirements, you may still be denied SSDI claims because you do not have enough work credits or haven't paid the FICA taxes.

How does your Work History Affect SSDI Qualification?

Ever wondered where does a chunk of your hard-earned money go, before you finally get your monthly paychecks? You must have noticed that often the amount you receive in your monthly paycheck may always be lesser than the amount initially stated on your work contract from the employer. This is because many companies pay the social security taxes on their employees. In short, all individuals who work have FICA taxes deducted from their paychecks automatically.

Since the SSDI is an insurance program it is funded by the Federal Insurance Contribution Act, FICA taxes collected from people who work and redistributed to those in need. If you pay FICA taxes, you basically pay into the Social Security Disability Insurance program. To be able to claim your social security you need to have worked and paid enough taxes into the system to retain coverage along with meeting the medical requirements.

How does your Income Impact your Eligibility for SSDI?

In assessing whether you qualify non-medically, the Social Security Administration (SSA) will initially look to whether you are right now working. In the event that you are working with low income wages below the stated threshold and not procuring a high income, you won't consequently be denied disability benefits, however completing a considerable measure of work, (for example, earning above a certain threshold) means that you'll be denied benefits.

As a matter of fact, in order to be able to earn disability benefits, you must be unable to perform any kind of substantial gainful activity (SGA).

The good news is, the SSDI does not consider the number of assets you may have or how much other family members contribute to the household, while analyzing your case for eligibility. The assets and income from other sources are only considered for the supplemental security income, SSI.

On the other hand, the SSA does take into account how much money you earn through your job. You can't earn an income equal to or more than the income stated in the 'substantial gainful activity', or otherwise your claims would be straight away denied.

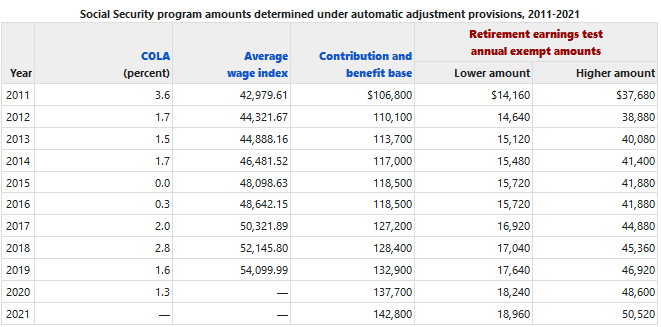

The specific dollar amount stated as substantial gainful activity in 2021 is $1310 for non-blind claimants and $2190 for blind claimants, per month. If your income is above the stated threshold, you will not be labeled as disabled by the SSA.You can refer to the chart below to find out approximate amount for your SSDI paycheck according to COLA adjustments.

Talk to a social security attorney

An experienced social security attorney will be able to analyze whether you will qualify for social security on your medical and non-medical terms or not. While you can always re-appeal your claims if you think you are denied unjustly on medical basis, you can never re-appeal if you do not qualify under the non-medical requirements.

A disability lawyer can not only determine your eligibility but also guide you on how you can become eligible in certain situations. Hence, it is highly recommended that you consult with a social security attorney while submitting your application.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.

Comments